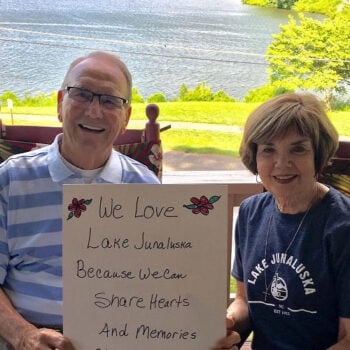

Your estate gifts help to advance Lake Junaluska’s mission to be a place of Christian hospitality where lives are transformed through renewal of soul, mind and body. Thank you!

Given the opportunity, most of us would like to make a lasting impact on the things we value and hold dear. Established in 2021, the Lake Junaluska Legacy Circle is composed of generous benefactors who have chosen to support Lake Junaluska’s long-term success by making a planned gift commitment. These charitable supporters have arranged for a gift through their will or living trust, life insurance, or other estate-related commitment.

Lake Junaluska Legacy Circle Members

Lake Junaluska is deeply grateful to the Legacy Circle members listed below for including Lake Junaluska Assembly in their estate plans. Their estate gifts will make a lasting impact and help to sustain the mission and ministry of Lake Junaluska for future generations. Thank you! Click below to view the full list of members:

- Expand Legacy Circle Members List contentCollapse Legacy Circle Members List contentLegacy Circle Members List

Rev. W. Robert and Dr. Barbara J.* Borom

Dr. and Mrs. Robert C. Bowling

Bernie and Snookie Brown

Jimmy* and Joy Carr

Ms. Dorathy M. Chance

Mr. Ronald Clauser and Mrs. Nancy Oates

Rev. Larry and Mrs. Gail Clifton

Mr. and Mrs. Frank L. Cooke

Mr. Kevin FitzGerald and Ms. Cynthia L. Slaughter

Ms. Susan Folds

Rev. Sandy and Rev. Susan Giles

Dr. Paul* and Mrs. Barbara Hardin

Dr. and Mrs. Edward R. Hardin

Camilla and Jay Hicks

Bobby Ray and Jill R.* Hicks

Davis and Brenda Hook

Ken and Suzanne Howle

Ms. Flo Johnson

Rev. Judith O. Jolly

Dr. and Mrs. David S. Lawson

Dr. Janice Lemasters

Dr. and Mrs. Jacob C. Martinson Jr.

Ms. Jane Clark Moorman

Joe Edd and Sandi Morris

Mr. and Mrs. William Musgrave

Rev. Cecil K.* and Mrs. Ellen R. Myrick

Rev. Larry and Mrs. Myrna* Roberts

Mr. Robert E. and Rev. Kathryn W. Scarborough

John and Sandra Scott

Dr. and Mrs. L. Reed Shirley

Mr. and Mrs. Eric E. Smith

Mr. and Mrs. Melvin Spain

Dr. Donald* and Mrs. Barbie Stanton

LTC and Mrs. L. Wilson Strickhausen

Dr. and Mrs. Harrison D. Turner

Mr. David H.* and Mrs. Lynda H. Varner

Mrs. Marleen A. Varner

Mr. William S.* and Mrs. Jean F. Ward

Anne and Mike Warren

Mr. and Mrs. Wayne G. Wegwart

Mr. and Mrs. George WoodsAn asterisk (*) denotes that a person is deceased

The Lake Junaluska Legacy Circle was established in 2021 and recognizes current charitable supporters who are including Lake Junaluska in their estate plans. If you have included Lake Junaluska in your estate plans, but do not see your name listed above it is most likely because the Lake Junaluska Development Office has not received written documentation of your planned gift to Lake Junaluska. Please contact the Development Office to join the Lake Junaluska Legacy Circle. Thank you!

(Members List current as of 01/23/2024)

Create Your Lake Junaluska Legacy

To discuss opportunities for a planned gift such as bequest, annuities or trusts, please contact the Office of Development at 828-454-6680.

The legal name and address for planned gift documents such as a will or beneficiary form is: Lake Junaluska Assembly, Inc., PO Box 67, Lake Junaluska, NC 28745.

See our Spring and Summer estate planning newsletters (PDFs in sidebar) for more information about ways to give.

Planned Giving Resources

- Download PDF Legacy Circle Summer 2023 Newsletter

- Download PDF Legacy Circle Summer 2022 Newsletter

- Download PDF Legacy Circle Spring 2022 Newsletter

- Download PDF Legacy Circle Spring 2022 Examples

- Download PDF Legacy Circle Summer 2021 Newsletter

- Download PDF Legacy Circle Spring 2021 Newsletter

- Download PDF Legacy Circle Membership Form

- Download PDF Legacy Circle Overview

- Download PDF Estate Planning Resource Tool

Browse Frequently Asked Questions

- Expand What Is Planned Giving? contentCollapse What Is Planned Giving? contentWhat Is Planned Giving?

Planned giving helps you plan your estate and charitable giving in a way that benefits you, your family, and charitable organizations whose values align with your own. Several types of planned gifts exist that not only help institutions such as Lake Junaluska but also provide tax and income benefits to you.

There are many ways you may provide for Lake Junaluska through your estate. Here are a few examples:

- Bequest: Including Lake Junaluska in your will through a bequest will reduce the size of your estate for federal estate tax purposes. Bequests can be unrestricted or designated. Types of bequests include outright, residual, percentage, or contingent.

- Trust: Establishing a trust can result in income provided to you during your lifetime and to certain beneficiaries for their lifetimes. Contributions of $100,000 or more are often used to fund the desired trust.

- Life Insurance: You can assign all rights of ownership of a current policy to Lake Junaluska and receive an income tax deduction in the year of the gift. You can assign a partially paid-up policy or purchase a new policy listing Lake Junaluska as the owner and beneficiary.

- Charitable Gift Annuity (CGA): A contract between you and Lake Junaluska which will provide a fixed annual income for life and income tax deduction benefits. Gifts ranging from $5,000 to $100,000 are usually selected to fund a CGA.

- Life Estate Agreement: Allow you to make a gift of a personal or secondary residence or family farm to Lake Junaluska. You retain the right to live in the house for life. You are responsible for upkeep, taxes, and insurance as long as you live in the home. This gives you substantial tax benefits.

- Expand How Do I Join the Legacy Circle? contentCollapse How Do I Join the Legacy Circle? contentHow Do I Join the Legacy Circle?

Whether you have already included Lake Junaluska in your estate plans or are in the process of doing so, joining the Lake Junaluska Legacy Circle is simple. Notify us of your planned gift intention by completing and returning the downloadable membership form below.*

Legacy Circle Membership Form (PDF)

* If you have previously notified Lake Junaluska of your planned gift commitment, but have not yet completed the membership form, we ask that you complete the form and provide any updated information about your planned gift. This will assist Lake Junaluska in being good stewards of your legacy gift. Thank you!

- Expand How Does Lake Junaluska Recognize Legacy Circle Members? contentCollapse How Does Lake Junaluska Recognize Legacy Circle Members? contentHow Does Lake Junaluska Recognize Legacy Circle Members?

Landscape Manager Melissa Tinsley fills custom planters with greenhouse-grown cuttings to give to Legacy Circle members.

Members of the Lake Junaluska Legacy Circle will receive special recognition and will be honored in a variety of ways, including:

- Recognition on our website

- Tributes in publications such as the Annual Report

- Invitations to special events at Lake Junaluska

- Custom-made Lake Junaluska Legacy Circle planter

QUESTIONS?

Please contact the Lake Junaluska Development Office at 828-454-6680 or [email protected].

TAX INFORMATION

Lake Junaluska Assembly, Inc. is a 501(c)(3) charitable organization. Gifts are tax-deductible. Our federal tax ID number is 56-0547461.